- #FREE CASH FLOW FORMULA FROM CASH FLOW STATEMENT HOW TO#

- #FREE CASH FLOW FORMULA FROM CASH FLOW STATEMENT FREE#

The most common document is the statement of cash flows from an organization because it already accounts for non-cash expenses and any changes in the working capital of an organization.

#FREE CASH FLOW FORMULA FROM CASH FLOW STATEMENT FREE#

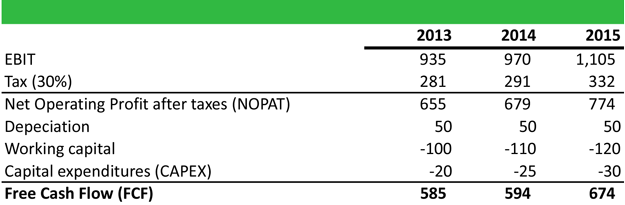

There are several financial documents you can use to calculate free cash flow. Operating cash flow is the revenue an organization makes minus its operating expenses.Ĭapital expenditures are the money an organization uses to maintain fixed assets such as buildings, equipment or land.īelow are the steps you can use to calculate free cash flow: 1. The most common method of calculating FCF is by using operating cash flow in the following formula:įree cash flow = operating cash flow − capital expenditures There are several ways to calculate free cash flow.

#FREE CASH FLOW FORMULA FROM CASH FLOW STATEMENT HOW TO#

Related: Guide to Cash Flow How to calculate free cash flow FCF is only the amount left after an organization spends cash to support daily operations and capital assets like land, property and operating machinery. A positive or negative cash flow gives investors an understanding of how a company performs financially. The key difference between the two is that cash flow is the net amount of cash or cash equivalents cycling in and out of the company. Free cash flow is also called "free cash flow to firms," abbreviated as "FCFF." This number is helpful to shareholders interested in the amount of cash that an organization or investor can withdraw from an organization without disturbing operations.įCF differs from cash flow, which appears on the cash flow statement. FCF is used to pay investors and shareholders. Learning how to read and interpret each statement and how to connect them all together with other retail metrics will definitely improve the financial performance of your retail business over time.Free cash flow is the amount of cash an organization generates after it accounts for operational expenses and funds it uses to manage assets. That’s why we always advice any retail or e-commerce business owner to look at their retail financial statements as a whole, and not only on the P&L statement. It is actually the wise thing to do in this case, although it results in loss on this inventory. You will also understand that sometimes it is ok to take a loss on some obsolete stocks, just to be able to free up cash flow for the business.

However now that you know what effect this will have on your cash flow and inventory turnover, you will think again and weigh all the pros & cons of taking that offer. You might think “ That’s great! This means higher margin and more profits for me“. Understanding all those dynamics will allow you to operate your retail or e-commerce business differently.įor example, you might be tempted to take that great offer the supplier is giving you of 20% off if you purchase more stocks. This could also mean that you will have to take out a loan or line of credit to meet all your payment deadlines, which will put additional cost of interests on you in the future. Your cash could be trapped due to having too much inventory, for example, or due to poor collection of invoice payments from your customers.

This will reduce your ability to take money out of your business or invest more money into growing & expanding your business. It means that you can be operating a very profitable store, yet you are not able to pay the bills month in and month out, due to poor cash flow management. So it will appear as 2000$ of depreciation and deducted from your profits each year for 5 years. On your P&L however, this amount is spread out over ,say, 5 years and recorded at 20% (2000$) each year. If you invest 10,000$ in a new equipment this goes straightaway out of your bank account at the time of investment, and hence reduces your cash by 10,000$.

The method used to calculate net profit in your P&L statement doesn’t reflect the amount of cash coming in or going out of the business for the same year. Many new business owners assume that making that amount of net profit at the end of the year automatically means they can get that same amount out of the business and use it for their expenses. This could be to buy new equipment, build new stores, buy a property.etc.ĭownload a monthly retail cash flow management excel template from the members area. Capital ExpenditureĬapital Expenditure or CAPEX is the the capital you invest in the business. – Other miscellaneous payments related to operations.

– Cash you paid to your vendors for your products – Cash you paid to operate the stores (rent, salaries, admin, marketing.etc) You can extract the figure for Cash From Operations from your cash flow statement.Ĭash you received from selling your products

0 kommentar(er)

0 kommentar(er)